Your Assessment Notice and Tax Bill

What is an assessment notice?

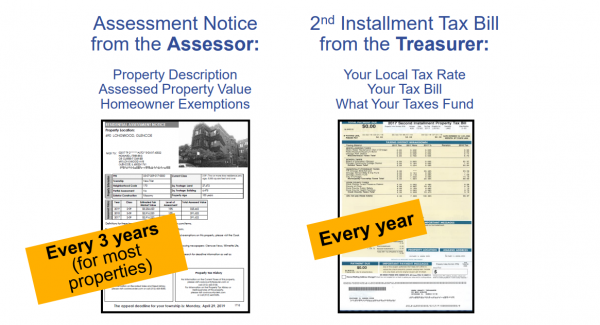

Your reassessment notice will look something like the above image.

It contains your home’s Property Index Number (PIN), characteristics, estimated fair market value, and assessed value. It also contains a list of exemptions applied to this property in the past few years.

How often is my property reassessed?

Cook County is reassessed triennially, which means one-third of the county is reassessed each year. This year, the south suburbs will be reassessed. The City of Chicago will be reassessed in 2021. The northern suburbs will be reassessed in 2022. Your property may also be reassessed if there are significant changes due to a permit application, property division, demolition, or other special application.

What is the difference between my assessment notice and my tax bill?

Your reassessment notice usually arrives once every three years after your township has been reassessed. Our schedule of reassessment mailing dates can be found here along with corresponding appeal dates. It does not require any action on your part though you may appeal if you believe the assessment is too high (see below).

Your annual tax bill comes from the County Treasurer’s Office in two installments: the first installment is due in March, and the second installment is due in August.

Your reassessment will affect the second installment tax bill the following year. So if your reassessment notice arrives in 2020, the tax bill reflecting this assessment will arrive in July of 2021. Any appeals of your reassessment value will be reflected in the second installment tax bill the following year.

How does the Assessor's Office value property?

We have explanations of our residential valuation and commercial valuation posted on our website.

If I believe the information on this notice is incorrect, how do I appeal?

If the characteristics listed for your home are wrong, if you think your home is worth less than the fair market value on this notice, or if you think there is information about your home that was not taken into account, you can file an appeal of your assessment.

Appeals can be filed with our office or with the Cook County Board of Review. Please see our Appeals section for information on how and when to file an appeal with our office. Visit cookcountyboardofreview.com for information and deadlines about appeals with their office.

If my assessment increases, does that mean that my tax bill will increase?

Not necessarily. The assessed value of your property is only one factor in determining your property taxes. Your total tax levy, set by local taxing bodies like schools, is an important factor in setting your tax rate.

Your property’s assessed value, tax rate, and exemptions will be used to calculate the second installment of the property tax bill you receive the following year. Property tax bills are sent by the Cook County Treasurer.

We have more information available on how our property tax system works here. To learn more about exemptions that can reduce your tax bill and file an application, visit our Exemptions section.

.png)

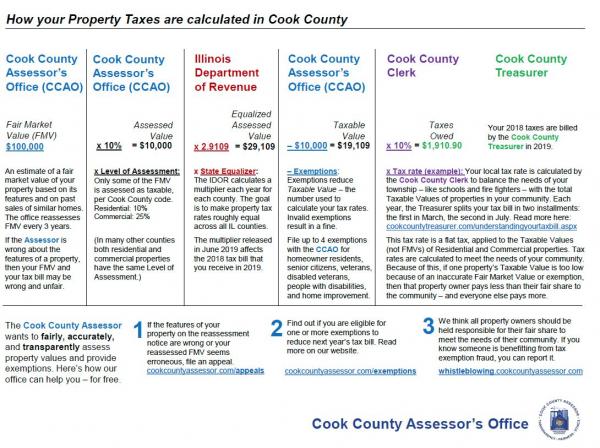

How is my assessment used to calculate my property taxes?

Property taxes are used to pay the levies set by local taxing bodies. Your assessed value determines your share of those levies relative to the total assessed value of your area. The levies and the total assessed value of an area determine your local tax rate.

After the assessor determines the Fair Market Value of your home, the Assessed Value of your home is calculated. For residential property owners, the assessed value equals 10% of the fair market value of the home. For most commercial property owners, the assessed value is 25% of the fair market value. This level of assessed value is the taxable amount of the property, as determined by Cook County ordinance.

Then the State Equalization Factor/Multiplier ("State Equalizer") is applied to the assessed value and this creates the Equalized Assessed Value (EAV) for the property.

Any Exemptions earned by the home are then subtracted from the EAV. Then the Tax Rate is applied to the tax levies for your community. Once those levies are added up, the total is the amount of property taxes you owe.

After any qualified property tax exemptions are deducted from the EAV, your local tax rate and levies are applied to compute the dollar amount of your property taxes. Please remember: each Tax Year's property taxes are billed and due the following year. For instance, 2019 taxes are billed and due in 2020.

Property tax bills are mailed twice a year by the Cook County Treasurer. Your first installment is due at the beginning of March. By law, the first installment property tax bill is exactly 55% percent of the previous year's total tax amount. The second installment property tax bill is mailed and due in late summer; it reflects new tax rates, levies, changes in assessments and any dollars saved by exemptions for which you have qualified and applied.

Here's an example of how a tax bill could be calculated, for a home with an estimated fair market value of $100,000 and a local tax rate of 8%. Please note the Equalized Assessed Value (EAV) is the partial value of the property. It is the figure on which the tax bill is calculated. Also note that exemptions are deducted from the EAV, which will likely lower the tax bill. The exemption amount is not the dollar amount by which the tax bill could be lowered.

| $100,000 | 2019 Estimated Fair Market Value |

| X.10 | Assessment Level (10% for residential properties) |

| $10,000 | 2019 Assessed Value |

| X 2.916 | 2019 State Equalizer |

| $29,160 | 2019 Equalized Assessed Value (EAV) |

| -10,000 | 2019 Homeowner Exemption |

| $19,160 | 2019 Adjusted Equalized Assessed Value |

| X.08 | 2019 Tax Rate (example; your tax rate could vary) |

| $1,532.80 | Estimated Tax Bill in dollars |

Property tax savings from a Homeowner Exemption are calculated by multiplying the Homeowner Exemption amount of EAV reduction ($10,000) by your local tax rate. Property tax savings from a Senior Exemption is calculated by multiplying the Senior Exemption amount of EAV reduction ($8,000) by your local tax rate.

Your local tax rate is determined by the Cook County Clerk each year, and can be found on your second installment tax bill or by contacting the Cook County Clerk’s Office at 312- 603-6566.

Enter PIN to see property details

Don’t know your PIN? Search by address here.