Rogers Park 2021 Valuation Reports

Reassessment notices for properties in Rogers Park Township were mailed to property owners on June 15, 2021. Appeals may be filed until July 19, 2021.

For details on Rogers Park's reassessments, real estate market data, and assessment methodology, read the full reports below.

The Cook County Assessor’s Office released initial assessments of residential and commercial properties in the township of Rogers Park. This is the first of eight townships in the City of Chicago to be reassessed in 2021 and the first Chicago township to be reassessed under the leadership of Assessor Fritz Kaegi, who took office after Chicago’s last reassessment in 2018.

Increases in assessments reflect a robust market. Assessments, under Illinois law, should reflect overall market values. The first step to ensuring property owners pay only their fair share of property taxes—without needing to file appeals to correct inaccurate assessments—is to make sure assessments of all property types accurately reflect the real estate market.

Residential modeling reports

| Property type | Property count | 2020 Sales: # | 2020 Sales: Range (bottom third, top third) | 2021 Model: Estimated Market Range (bottom third, top third) | 2021 Model Report |

|---|---|---|---|---|---|

| Single-family homes |

5,600 | 216 | $330k to $460k | $320k to $410k | Assessment Report |

| Multi-family (six units or less) |

2,100 | 52 | $450k to $560k | $430k to $550k | Assessment Report |

| Condos (class 2-99) |

11,600 | 539 | $120k to $170k | $130k to $170k | Assessment Report |

Residential assessments are based on several factors, including location, age, neighborhood school boundaries, square footage, construction material, and the number of bedrooms and bathrooms.

The Estimated Market Values produced by the model are reviewed by our analysts, neighborhood by neighborhood. If warranted, our analysts refine the Estimated Market Values predicted by the model before the value is mailed to the homeowner.

Commercial reports

Rogers Park's commercial properties contain about:

- 800 apartment buildings

- 40 office buildings

- 15 industrial buildings

- 65 retail shopping centers or other special commercial properties (classes 5-31 and 5-97)

In the three years since 2018's reassessment, commercial real estate sale prices and rents—therefore, estimated market values and assessed values—have grown overall from 2018 to 2021 for most property types.

In the last year, COVID-19 and associated shutdowns have had varying effects throughout Chicago. Hotels and retail properties are among the sectors with the largest declines since the onset of COVID, whereas large multifamily apartments, grocery stores, industrial buildings, and data centers have been stable or even met positive growth since the onset of COVID.

- Market rents for apartments in Rogers Park range from $780 to $2000 a month. Market vacancy is at 9%.

- Market values are estimated from $47,000 to $208,000 per unit.

- Offices in Rogers Park range in size from 2,200 to 48,000 in square footage and are assessed at $17-18 in rent per square foot with 5% market vacancy.

- Estimated market values are $75-$120 per square foot.

This commercial assessment report contains information about rents, expenses, and capitalization rates used by the Assessor's Office to determine assessments, including offices, hotels, industrial. and large multi-family apartments. For more on the Assessor's Office's commercial assessment methodology, read How Commercial Properties Are Valued.

Events for Rogers Park Township homeowners

The Assessor's Office staff host virtual events to provide information and answer your questions about reassessments and appeals. See the full list.

Appeals

If the property characteristics listed on your assessment notice are incorrect, or if the estimated market value of your home is significantly more than what you believe your home could sell for in the current real estate market, you should file an appeal. The last date to file an appeal is printed on your notice. A good rule of thumb is this: If the property characteristics on this notice are correct and the estimated market value is within 10 percent of what you think your home is worth then it is unlikely that an appeal would change your property’s assessed value enough to significantly affect its property tax bill.

If you would like to file an appeal of your property's assessment, we encourage you to file online. The appeal deadline for Rogers Park is July 19, 2021.

For assistance with appeals, contact the CCAO's main office via phone, email, or social media. In-person visits are currently available by appointment.

How assessments relate to property taxes

Property assessments in Chicago are used to apportion taxing district levies which pay for services such as schools, parks, libraries, and pensions. The Assessor does not set levies or tax rates. Also, increases in assessments do not necessarily increase the revenue received by taxing districts.

It is important to understand that an increase in a property's assessment does not lead to the same increase in an individual property’s tax bill. A property’s share of taxes depends on reassessments throughout all of Chicago, from homes in Chatham and Jefferson Park to commercial properties in Little Village and the Loop.

It is important to understand that an increase in a property's assessment does not lead to the same increase in an individual property’s tax bill. A property’s share of taxes depends on reassessments throughout all of Chicago, from homes in Chatham and Jefferson Park to commercial properties in Little Village and the Loop.

If the growth in assessed values elsewhere in Chicago outpaces the growth of an individual property’s assessment, that individual property’s share of property taxes could shrink despite its increase in property value. In 2018, properties in Rogers Park made up 2% of Chicago’s total assessed value.

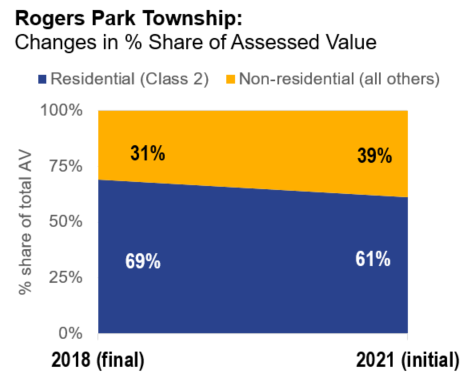

At the end of the 2018 reassessment cycle, 69% of Rogers Park’s total assessed value was residential, with the other 31% comprised of non-residential and multifamily properties.

The 2021 initial reassessed values have shifted this to 61% residential, and 39% non-residential and multifamily properties. These percentages may change at the final stage of assessment, after appeals are processed by the Assessor's Office and by the Board of Review

2021 assessments will affect the second installment property tax bill issued in late 2022.

How residential assessments are calculated

Residential assessments are based on several factors, including location, age, neighborhood school boundaries, square footage, construction material, and the number of bedrooms or bathrooms.

In order to detect the many different ways that homes’ physical characteristics and locations impact sale prices over time, we design a range of statistical, algorithmic models, which are then tested to see how well they compare to actual databases of sale prices. analysts examine estimated market values for different property classes, neighborhood by neighborhood, to verify that the model has performed effectively and that values fall in a reasonable range.

Improvements to data and modeling used by the Assessor’s Office since 2018 have improved assessment accuracy, uniformity, and equity—for neighborhoods, and for individual homes.

How commercial assessments are calculated

Our office first determines a property’s use (office, retail, apartments, industrial, etc.) and group the property with similar or like-kind property types. Then we examine the income generated by the property such as rent or incidental income streams like parking or advertising signage. Next, we examine market-level vacancy based on location and property type. In addition, new construction that has not yet been leased is also considered. Finally, we look at expenses such as property taxes, insurance, repair and maintenance costs, property management fees, and service expenditures for professional services. Once we’ve been able to recreate a snapshot of a property’s income statement based on market data, we use a standard valuation metric called a “capitalization rate” to convert income to value.

More information on how assessments are calculated can be found at the How Properties Are Valued page.

Enter PIN to see property details

Don’t know your PIN? Search by address here.